Learn about all the types of plans that UnitedHealthcare offers.

Medicare Advantage (MA) plans are health plan options approved by Medicare and offered by private insurance companies that are contracted by the federal government. MA plans provide Medicare Part A (hospital) and Medicare Part B (medical) coverage, and most plans also include Medicare Part D (prescription drug) coverage. Medicare Advantage plans also include other benefits and services such as dental, vision, hearing and fitness that Original Medicare does not cover.

UnitedHealthcare offers different types of Medicare Advantage plans (non-SNP, D-SNP, C-SNP, I-SNP) and plans include additional benefits and services beyond Original Medicare that may vary from plan to plan. Ultimately, our goal is to offer a plan to sell to meet the needs of every Medicare eligible consumer in the markets we serve.

Search, view, and compare UnitedHealthcare Medicare Advantage plans on the Medicare Product Portal.

Agent Reference Materials for 2024 - Medicare Advantage

-

- New Plan Names opens in a new window

- Medical Deductible Overview opens in a new window

- 2024 UHC MAPD Formulary Update opens in a new window

- 2024 UHC C-SNP Formulary Information opens in a new window

- 2024 Inflation Reduction Act FAQ opens in a new window

- Understanding Drug Cost Estimator (DCE) Pricing opens in a new window

AARP® Medicare Supplement Insurance Plans

AARP Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company or an affiliate are health insurance plans designed to supplement Original Medicare. They help pay some or all of the health care costs that Original Medicare does not cover (like copayments, coinsurance, and deductibles).

UnitedHealthcare offers AARP Medicare Supplement Plans A, B, C, F, G, K, L, and N (except in Massachusetts, Minnesota and Wisconsin, which have different plans and plan designations). Each plan has specific benefits so consumers can find one to best meet their needs and budget. Use language highlighted in this messaging platform when discussing plan options with consumers.

Note: In states where both UnitedHealthcare Insurance Company (UHIC) and UnitedHealthcare Insurance Company of America (UHICA) plans are available you will see separate documents identified for each. You are only permitted to access materials for plans you are authorized to offer.

Eligibility/Availability

General Eligibility

The following eligibility rules apply for AARP Medicare Supplement applicants:

- Enrolled in Medicare Part A and Part B

- Both must be active at time of the plan effective date

- A resident of the state in which they are applying for coverage

- Age 65 or older

- AARP membership (may enroll at time of application

Plans are available to people under age 65 and disabled in some states.

Note:

In states where both UnitedHealthcare Insurance Company (UHIC) and UnitedHealthcare Insurance Company of America (UHICA) plans are available you will see separate documents identified for each. You are only permitted to access materials for plans you are authorized to offer.

Your Guide

Please view applicable state-specific directories on the Sales Materials Portal

Availability and Eligibility Guides

Please view applicable state-specific directories on the Sales Materials Portal

AARP Medicare Select Availability

Rates & Underwriting

Underwriting requirements vary by state and product. Underwriting is used to determine eligibility and/or the rate, when applicable. Underwriting decisions are based on the information provided on the application as well as information received during the underwriting process.

Rate structures, discounts and rate guarantees also vary by state and product. Please refer to the state-specific information in the Producer Handbooks available on the Sales Materials Portal.

Note:

In states where both UnitedHealthcare Insurance Company (UHIC) and UnitedHealthcare Insurance Company of America (UHICA) plans are available you will see separate documents identified for each. You are only permitted to access materials for plans you are authorized to offer.

Underwriting and

Rate Guides

Not Applicable

Plan Changer Rate

Not Applicable

Annual Rate Change

Not Applicable

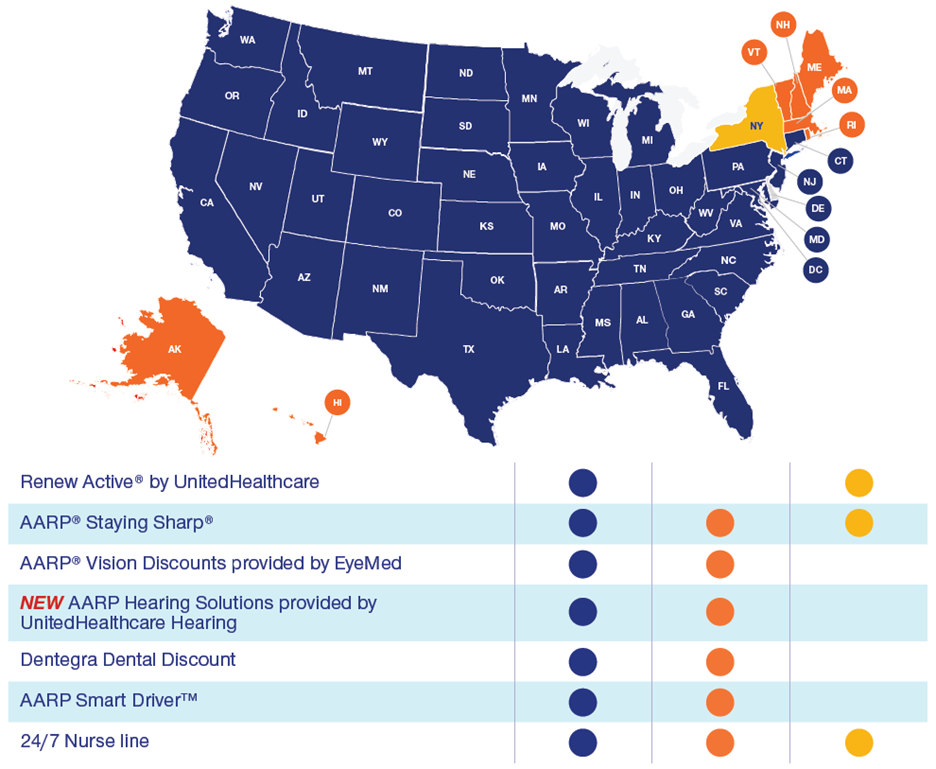

Wellness Extras (Value-Added Services)

AARP Medicare Supplement Plans insured by UnitedHealthcare Insurance Company (UHIC) and insured by UnitedHealthcare Insurance Company of America in North Dakota offer wellness extras. Because Medicare supplement plans are standardized, one of the ways (aside from premium) that plans can be differentiated in the market is through value-added services.

Plan members can receive the following additional services at no additional cost. These services are separate from the Medicare supplement plan benefits and vary by state. For more detailed information, please view the state-specific Enrollment Kits and Producer Handbooks.

For New York Certificate holders, these offers are only available to insured members covered under an AARP Medicare Supplement Plan insured by UnitedHealthcare Insurance Company of New York. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits and are subject to geographical availability.

For all other state Certificate holders, these offers are only available to insured members covered under an AARP Medicare Supplement Plan insured by UnitedHealthcare Insurance Company. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time.

Note that certain services are provided by Affiliates of UnitedHealthcare Insurance Company or other third parties not affiliated with UnitedHealthcare.

Wellness Extras Availability:

2024

AARP Medicare Rx Preferred from UHC (PDP)

Choose this plan if you want UnitedHealthcare's most extensive drug coverage and access to a broad pharmacy network

- $0 deductible

- $0 copay for a 3-month supply of Tier 1 and Tier 2 prescriptions with Optum Home Delivery

- $35 or less for a 1-month supply of covered insulin prescriptions

- $0 copay for most Part D covered adult vaccines including Shingrix

- $0 cost share for all Medicare Part D covered drugs in the Catastrophic Drug Payment Stage

AARP Medicare Rx Walgreens from UHC (PDP)

Choose this plan if you fill your prescriptions primarily at Walgreens pharmacies

- $0 deductible on Tier 1 prescriptions

- $2 copay for over 200 generic drugs at Walgreens pharmacies nationwide

- $35 or less for a 1-month supply of covered insulin prescriptions

- $0 copay for most Part D covered adult vaccines including Shingrix

- $0 cost share for all Medicare Part D covered drugs in the Catastrophic Drug Payment Stage

AARP Medicare Rx Basic from UHC (PDP)

Choose this plan if you receive Extra Help from Medicare

- $35 or less for a 1-month supply of covered insulin prescriptions

- $0 copay for most Part D covered adult vaccines including Shingrix

- $0 cost share for all Medicare Part D covered drugs in the Catastrophic Drug Payment Stage

AARP Medicare Rx Saver from UHC (PDP)

Choose this plan if you want a more robust pharmacy network

- $35 or less for a 1-month supply of covered insulin prescriptions

- $0 copay for most Part D covered adult vaccines including Shingrix

- $0 cost share for Medicare Part D covered drugs in the Catastrophic Drug Payment Stage

- Take advantage of over 65,000 in network pharmacies nationwide

Agent Reference Materials - PDP

![]() Prescription Drug Reference Guide

Prescription Drug Reference Guide

![]() 2024 Part D Plan and Benefit Offerings

2024 Part D Plan and Benefit Offerings

![]() UnitedHealthcare Vaccine Coverage

UnitedHealthcare Vaccine Coverage

UnitedHealthcare® Dental, Vision, Hearing Plans

UnitedHealthcare Dental, Vision, Hearing (DVH) Plans* are bundled dental, vision, hearing coverage, for individuals ages 65+, that are designed to be sold at the same time as an AARP® Medicare Supplement Insurance Plan from UnitedHealthcare® or separately.

These plans are true insurance plans, not a discount, and sold exclusively through agents like you, with an intuitive ‘add to cart’ shopping experience within the online enrollment tool and no additional certification needed to sell!

*Hearing benefits are not available in Ohio.

Why Dental, Vision, and Hearing Insurance?

For your clients, taking care of their health goes beyond regular medical checkups. Dental, vision, and hearing health are just as important to their overall well-being. Original Medicare (Parts A & B) does not cover routine dental and eye exams, hearing aids, and related exams and services.

Having a supplemental plan like UnitedHealthcare Dental, Vision, Hearing*, in addition to an AARP Medicare Supplement Plan, can help provide your clients with the additional coverage they need to protect their overall health, and budget.

*Hearing benefits are not available in Ohio.

What do UnitedHealthcare Dental, Vision, Hearing Plans include?

- Dental Coverage: Use dental benefits right away, no wait for most services!

- Coverage without waiting periods for preventive, basic and most major services1 such as exams, cleanings, crowns and root canals. So, your clients can start using them right away!

- Vision Coverage: Eye exams and eyewear, no waiting period!

- Vision health and routine eye exams have been shown to help with early detection of serious medical conditions. Coverage includes annual vision exams, and glasses or contacts, from a vision network with both private practice and leading retail providers.2

- Hearing Coverage: Help with hearing aids, including over the counter!

- Hearing loss is an invisible problem that can affect your clients’ social life, safety and overall well-being. The plans include benefits from UnitedHealthcare Hearing, such as annual hearing exams and hearing aids, including over the counter (OTC) hearing aids.3

1Major services not covered on 500 and 500 Plus plans. 12-month waiting period for Implant coverage (available on 3000 and 3000 Plus plans only.)

2Coverage for glasses (standard lenses and frames) or contact lenses once every 24 months.

3When you use a network provider. Hearing aid benefit available every 2 calendar years. Hearing benefit not available in Ohio.

Plan Availability

Dental, Vision, Hearing Plans are sold exclusively through agents like you, through the AARP Medicare Supplement Plan online enrollment tool. These plans can be sold at the same time as an AARP Medicare Supplement Plan insured by UnitedHealthcare Insurance Company (UHIC) or UnitedHealthcare Insurance Company of America (UHICA).

Find more information on plans, rates, and networks by logging into the online enrollment tool for Medicare supplement.

Resources

- MARKETING

- Search “DVH” in the UHC Agent Toolkit for customizable, state-specific marketing pieces

- Customizable materials include flyers, Facebook posts, and promotional items

- Consumer Brochure

- DVH state-specific consumer brochures will be provided to your clients during the online enrollment process but are also a valuable resource during the sales process to educate your clients on the plan options, benefit details, and provides links to network providers.

- DVH Rate Pages, Policies Effective 4/2024-6/2024

- DVH Rate Pages, Policies Effective 7/2024-9/2024

- DVH Rate Pages, Policies Effective 10/2024-12/2024

- DVH Provider Search

- Search “DVH” in the UHC Agent Toolkit for customizable, state-specific marketing pieces

- TRAINING

- Find on-demand training, helpful DVH Job Aides, and DVH Sample Policies by searching “DVH" or "Dental, Vision, Hearing" in Learning Lab

- Check out the National Training Calendar for live training sessions

By using the Plan Search tool, it will allow you to explore all available plan options.